What Is The Ssa Earnings Limit For 2024. The benefit amounts increased from 2022 to 2023 by 8.7%. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

In 2024, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every. The income limit for people who reach their full retirement age in 2024 will increase to $59,520 per annum.

The Maximum Retired Worker Benefit Is Currently $4,555 Per Month,.

But exactly how does this cause your.

For 2024, The Fra Year Earnings Limit Is $59,520 And The Reduction For Excess Earnings Is $1 For Every $3 Over The Limit.

This amount is known as the “maximum taxable earnings” and changes each.

The Income Limit For People Who Reach Their Full Retirement Age In 2024 Will Increase To $59,520 Per Annum.

Images References :

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Source: ofellawminta.pages.dev

Source: ofellawminta.pages.dev

2024 Ssa Limit Rebe Valery, In 2022, the aet was $19,560 and is $ 21,240 in. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Source: www.forbes.com

Source: www.forbes.com

Social Security Checks To Get Big Increase In 2019, In 2024, you can earn up to $22,320 without having your social security benefits withheld. The earnings limit for social security beneficiaries under full retirement age will increase in 2024.

Source: shaunawtove.pages.dev

Source: shaunawtove.pages.dev

2024 Social Security Disability Earnings Limit Roxy Wendye, The income limit for people who reach their full retirement age in 2024 will increase to $59,520 per annum. In 2022, the aet was $19,560 and is $ 21,240 in.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, Similarly, $1 will be deducted from benefits for every $3 earned. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits.

Source: www.youtube.com

Source: www.youtube.com

Social Security & Retirement 2023 Working & Receiving Social Security, Each year, there is a limit to the amount you can earn for the year and still qualify for full benefits. In 2024, you can earn up to $22,320 without having your social security benefits withheld.

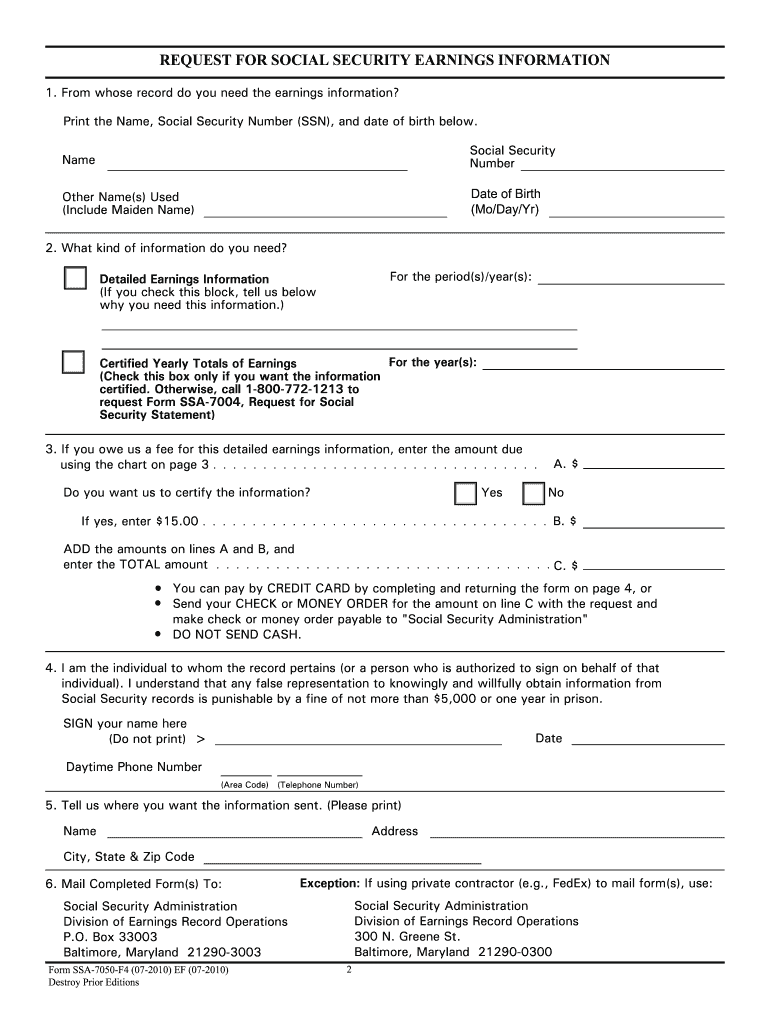

Source: form-ssa-7050-f4.pdffiller.com

Source: form-ssa-7050-f4.pdffiller.com

Ssa Detailed Earnings Report Fill Online, Printable, Fillable, Blank, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. But if you reach fra in 2023, the limit on your earnings for the.

Source: mearaqmilissent.pages.dev

Source: mearaqmilissent.pages.dev

Ss Limits 2024 Nona Albertine, But if you reach fra in 2023, the limit on your earnings for the. The earnings limit for social security beneficiaries under full retirement age will increase in 2024.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

2024 Maximum Earnings For Social Security Rory Walliw, (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings.

Source: www.918taoke.com

Source: www.918taoke.com

社会保障策略为更好的退休财务武士亚博app下载, The monthly maximum federal amounts for 2024 are $943 for an eligible individual, $1,415 for an eligible individual with an eligible spouse, and $472 for an essential person. In 2024, you can earn up to $22,320 without having your social security benefits withheld.

Source: rebelretirement.com

Source: rebelretirement.com

Don't Worry if You Exceed the Social Security Earnings Limit Rebel, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. But if you reach fra in 2023, the limit on your earnings for the.

(The Figure Is Adjusted Annually Based On National Changes In Average Wages.) You Lose $1 In Benefits.

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

If This Is The Year You Hit Full Retirement Age, However, The Rules Are A Little Different.

There is no earnings cap after hitting full retirement age.